Navigating GST Refunds as a QRMP Taxpayer: Lessons from GSTN Advisory No. 608

(QRMP GST Refund Validation)

On June 7, 2025, the GST Network (GSTN) released Advisory No. 608, introducing a critical validation mechanism for refund applications filed by taxpayers under the QRMP (Quarterly Return Monthly Payment) scheme. The update mandates that refund applications will now be accepted on the GST portal only if the system detects that all necessary return filings—particularly IFF (Invoice Furnishing Facility) and GSTR-3B—are complete and accurate. This new layer of QRMP GST refund validation aims to reduce errors, improve consistency in return data, and ensure that only eligible taxpayers can apply for GST refunds. Understanding the implications of this change is essential for tax professionals, accountants, and businesses operating under the QRMP framework.

Table of Contents

- Navigating GST Refunds as a QRMP Taxpayer: Lessons from GSTN Advisory No. 608

- 📢Understanding the Latest GSTN Advisory for QRMP Refunds

- 🧾The Foundation of GST Refunds: Timely & Accurate Return Filing

- ⚠️ Common Mistakes QRMP Taxpayers Make (That Block Refunds)

- 💡 Why a Robust GST Software is Essential for QRMP Success

- 📌 Introducing TaxPower GST: Your Smart Solution for QRMP Compliance & QRMP GST Refund Validation

- 📚More Reading Suggestions

- ❓ Frequently Asked Questions

- ✅Conclusion

- 📣Call to Action

📢Understanding the Latest GSTN Advisory for QRMP Refunds

The advisory outlines that many refund applications by QRMP taxpayers are being rejected due to mismatches in invoice data. Specifically, invoices disclosed in GSTR-1/IFF are not being reflected in GSTR-2A/2B due to non-filing or late filing of IFF. This discrepancy causes the refund system to throw errors, thereby blocking applications — despite taxpayers assuming their data is correct.

🧾The Foundation of GST Refunds: Timely & Accurate Return Filing

GST refund claims are governed by CBIC Circular No. 125/44/2019-GST, which requires that details of outward supplies must appear in GSTR-2A for a valid refund claim. For QRMP taxpayers, this includes filing the Invoice Furnishing Facility (IFF) data accurately and on time.

If the IFF is not filed, the invoice data doesn’t reflect in the buyer’s GSTR-2A/2B — thereby violating eligibility requirements.

⚠️ Common Mistakes QRMP Taxpayers Make (That Block Refunds)

- Missing IFF filing for outward supplies, Missing IFF Validation

- Incorrect period selection in IFF (e.g., uploading in May instead of April)

- Mismatch in invoice values between GSTR-1 and GSTR-3B

- Delayed GSTR-3B submission after filing IFF.

All these lead to system-level validation errors that can be easily avoided with the right software workflow.

💡 Why a Robust GST Software is Essential for QRMP Success

✅ Eliminating Manual Errors

Software like TaxPower GST automates your IFF process and provides real-time validations to prevent data entry errors.

🔄 Ensuring Data Consistency

It ensures that your invoices, GSTR-1/IFF, and GSTR-3B are in sync, greatly improving your refund eligibility.

📌 Staying Ahead of GSTN Advisories

TaxPower GST is always updated almost in real-time to reflect the latest compliance requirements and GSTN advisories — such as Advisory No. 608.

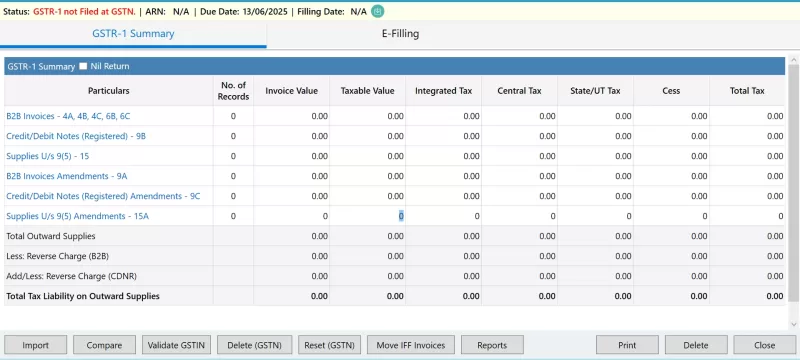

📌 Introducing TaxPower GST: Your Smart Solution for QRMP Compliance & QRMP GST Refund Validation

TaxPower GST makes refund processing easy for QRMP taxpayers with the following features:

- User friendly IFF Filing: Avoids manual data duplication and errors

- GSTR-1 & 3B Synchronization: Matches outward supply values for system validation

- Smart Reconciliation Engine: Aligns data across GSTR-2A/2B, books, and returns

- Validation Checks: Alerts for missed IFF or mismatched values before submission

- User-Friendly Dashboard: Enables easy tracking of refund status and return filings

📚More Reading Suggestions

- GST Compliance Features in TaxPower GST

- Request Demo of TaxPower GST

- Read: Auto-Populated GSTR-3B Advisory

❓ Frequently Asked Questions

What is QRMP full Form?

It is Quarterly Return Monthly Payment.

What is GSTN Advisory No. 608?

It is a GSTN alert warning that QRMP taxpayers are facing refund rejection due to unfiled IFF or data mismatches.

How does it affect QRMP taxpayers?

Refunds are system-validated against IFF and GSTR-2A/2B data. If IFF isn’t filed, refunds may be rejected.

What happens if I don’t file IFF correctly?

Your invoices won’t appear in buyer’s GSTR-2A. Refund applications will fail due to non-traceable invoice data.

Where can I read the official advisory?

Access GSTN Advisory No. 608 here: Click here.

How does TaxPower GST simplify QRMP refunds?

TaxPower GST Software provides Userfriendly functionality to file QRMP return – IFF and Challan GST PMT-06 with minimum errors. And hence ensure flawless refund application which is also available in TaxPower GST Software.

Is the TaxPower GST free trial really free?

Yes, you can explore all features including QRMP tools for 30 days — no cost or commitment.

✅Conclusion

GSTN Advisory No. 608 is a wake-up call for QRMP taxpayers. Filing IFF properly and aligning it with GSTR-3B is essential for successful refund claims. With TaxPower GST, this complex process becomes effortless — letting you stay compliant and worry-free and QRMP GST refund validation process should not be a challenge to you.

📣Call to Action

Don’t let IFF mismatches delay your GST refunds! Start your 30-day free trial of TaxPower GST and simplify your refund process with seamless compliance.

Disclaimer:

This blog is intended for informational purposes only and should not be considered legal or financial advice. Readers are encouraged to independently verify all applicable GST laws, regulations, CBIC advisories, GSTN guidelines, and E-Way Bill rules before making decisions. The author and publisher are not responsible for any actions taken based on the information provided here.