Annual Reconciliation in Tax Power GST Software

GST Annual Reconciliation in Tax Power GST Software:-

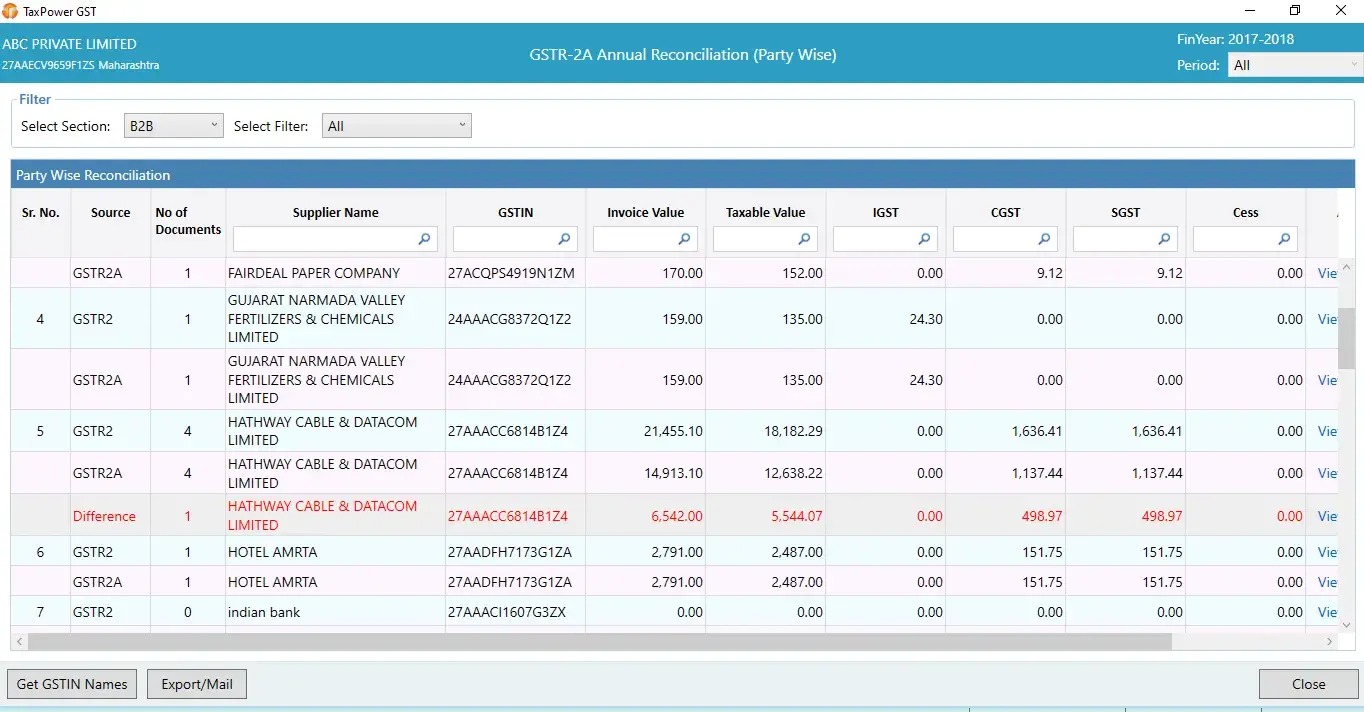

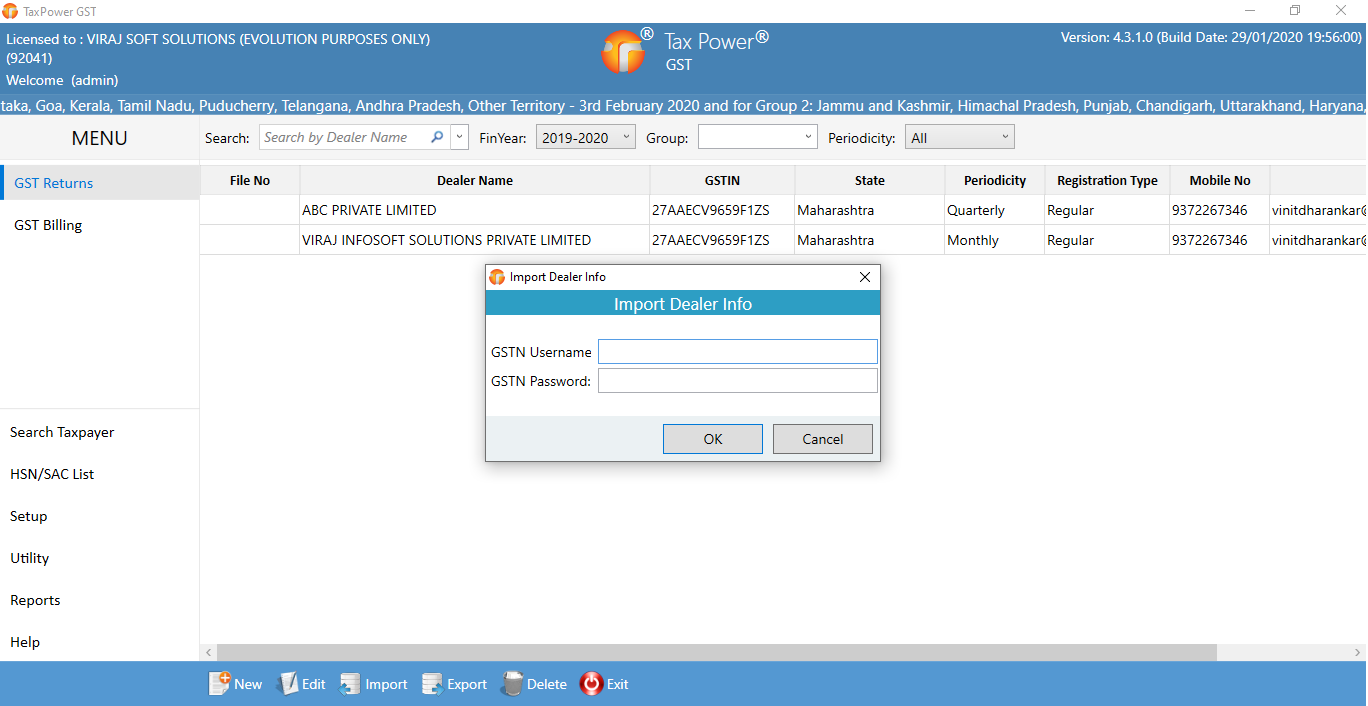

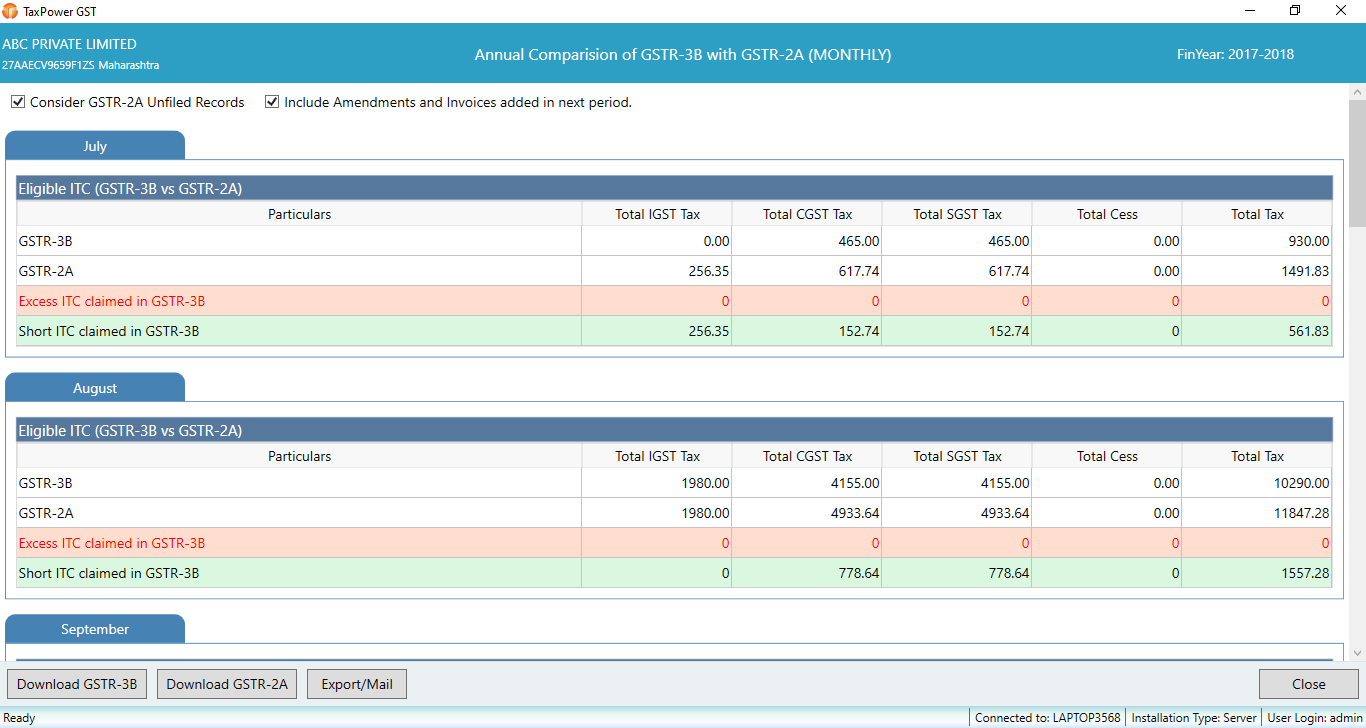

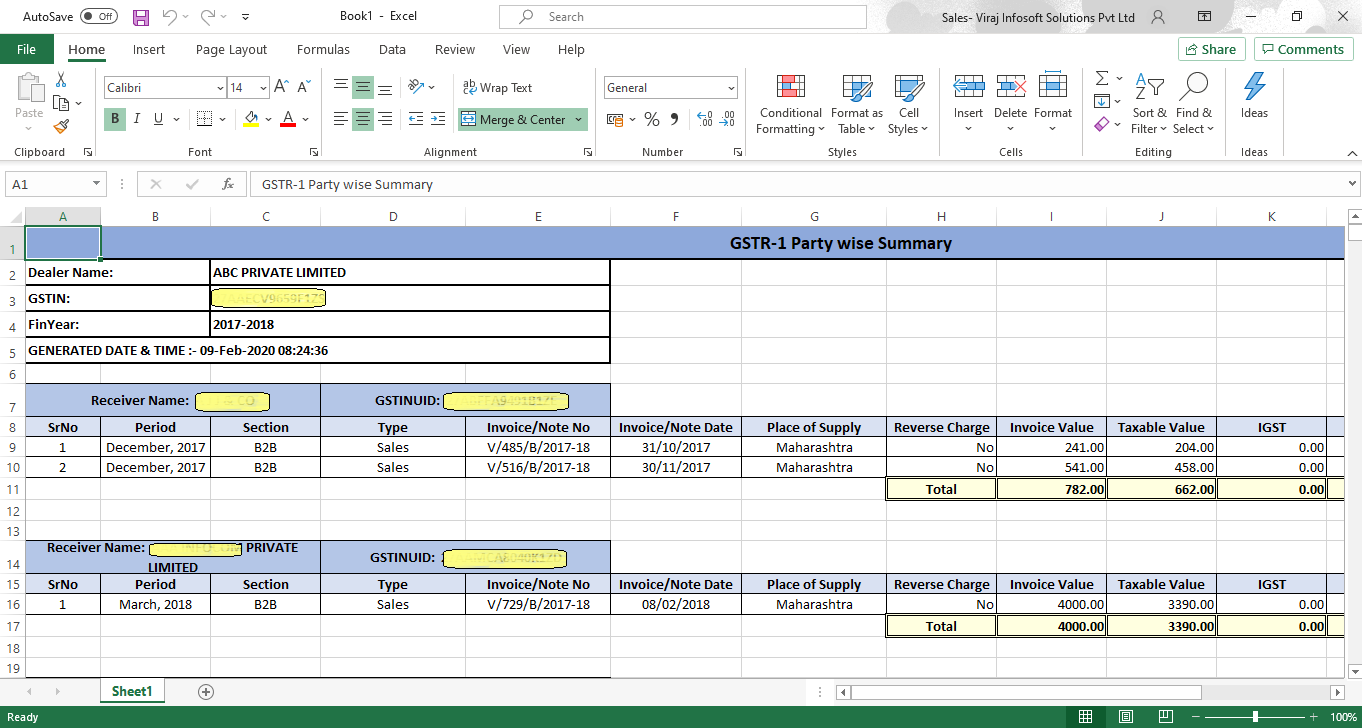

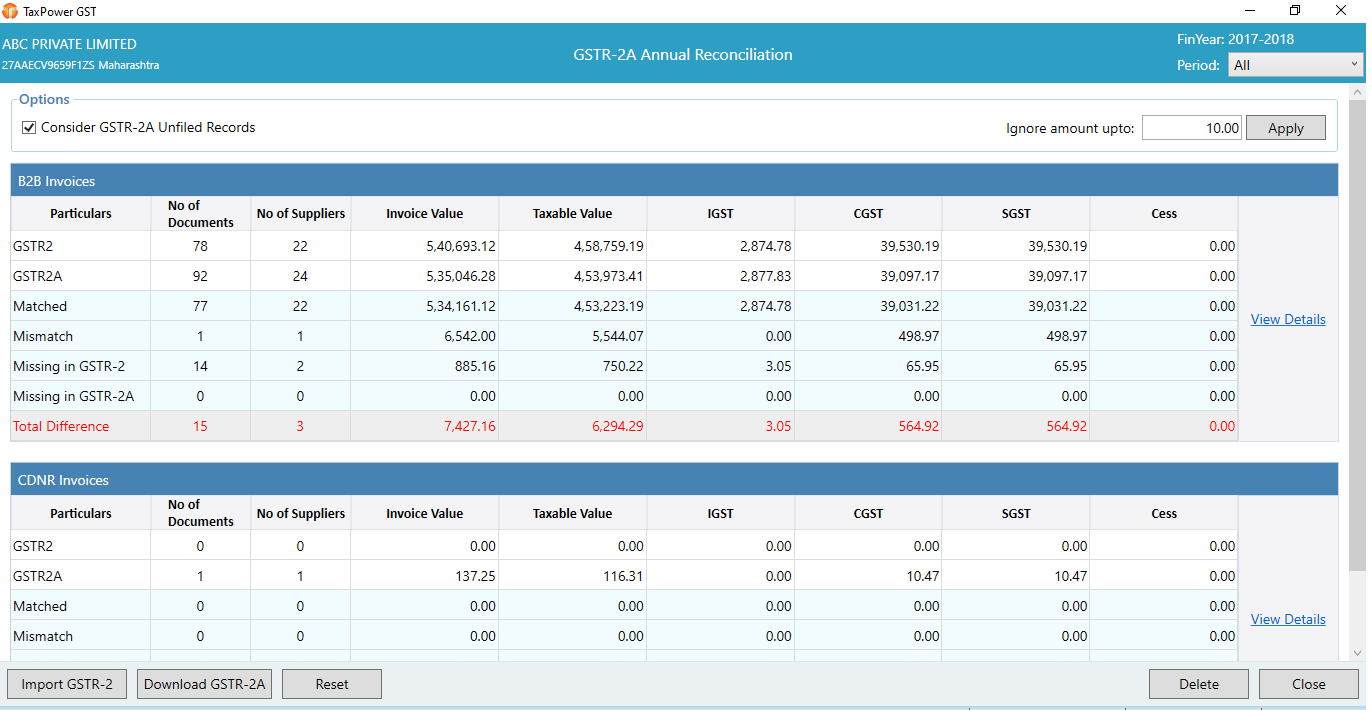

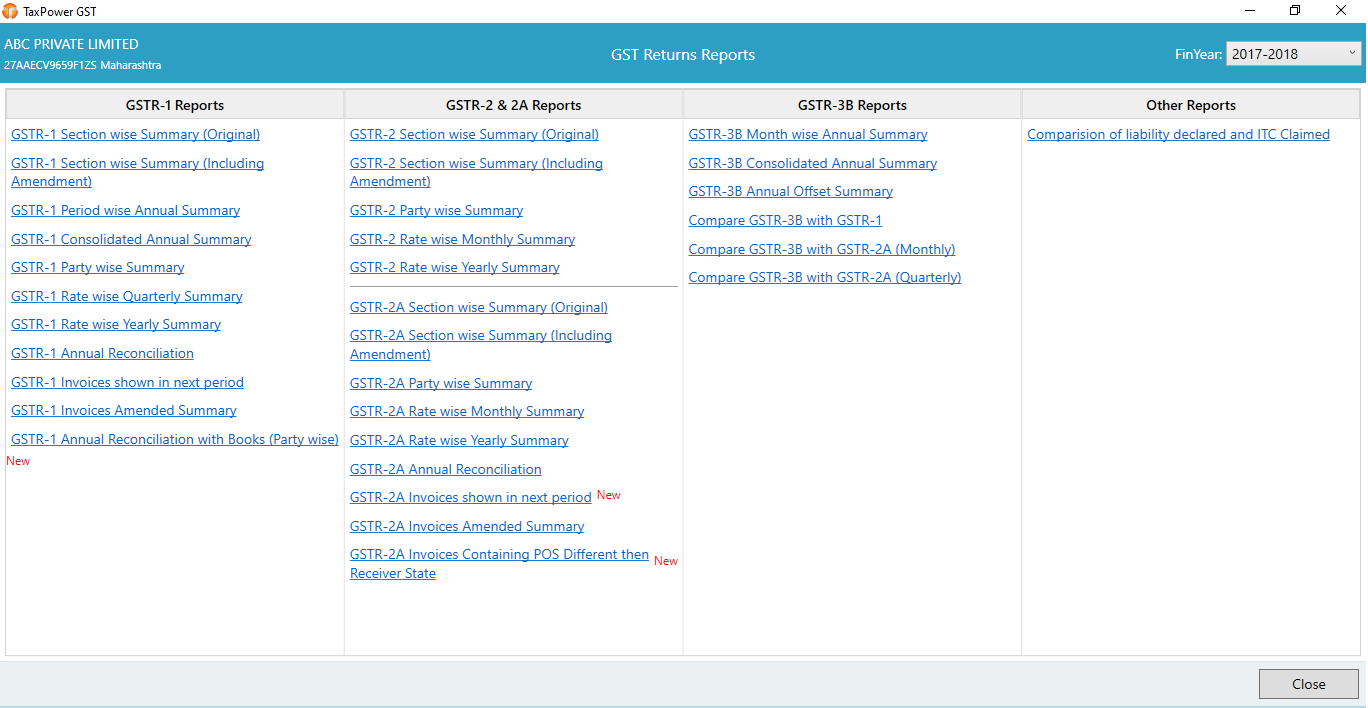

Nowadays it is important to do reconciliation of GSTR-2B, GSTR-2A, and GSTR-3B on period to period basis to get maximum ITC as equal to Annual Reconciliation. In Tax Power GST Software it is done with Simple and Powerful Tools. There are smart and intelligent algorithms used in the process.

Annual Reconciliation in Tax Power GST Software

GST Annual Reconciliation in Tax Power GST Software:-

Nowadays it is important to do reconciliation of GSTR-2B, GSTR-2A, and GSTR-3B on period to period basis to get maximum ITC as equal to Annual Reconciliation. In Tax Power GST Software it is done with Simple and Powerful Tools. There are smart and intelligent algorithms used in the process.