GSTR-3A Notice for Cancelled Composition Taxpayers – GSTN Advisory 618 (July 2025)

GSTR-3A Notices for Non-Filing of GSTR-4 by Cancelled Composition Taxpayers – GSTN Advisory 618 Explained Have you received a [...]

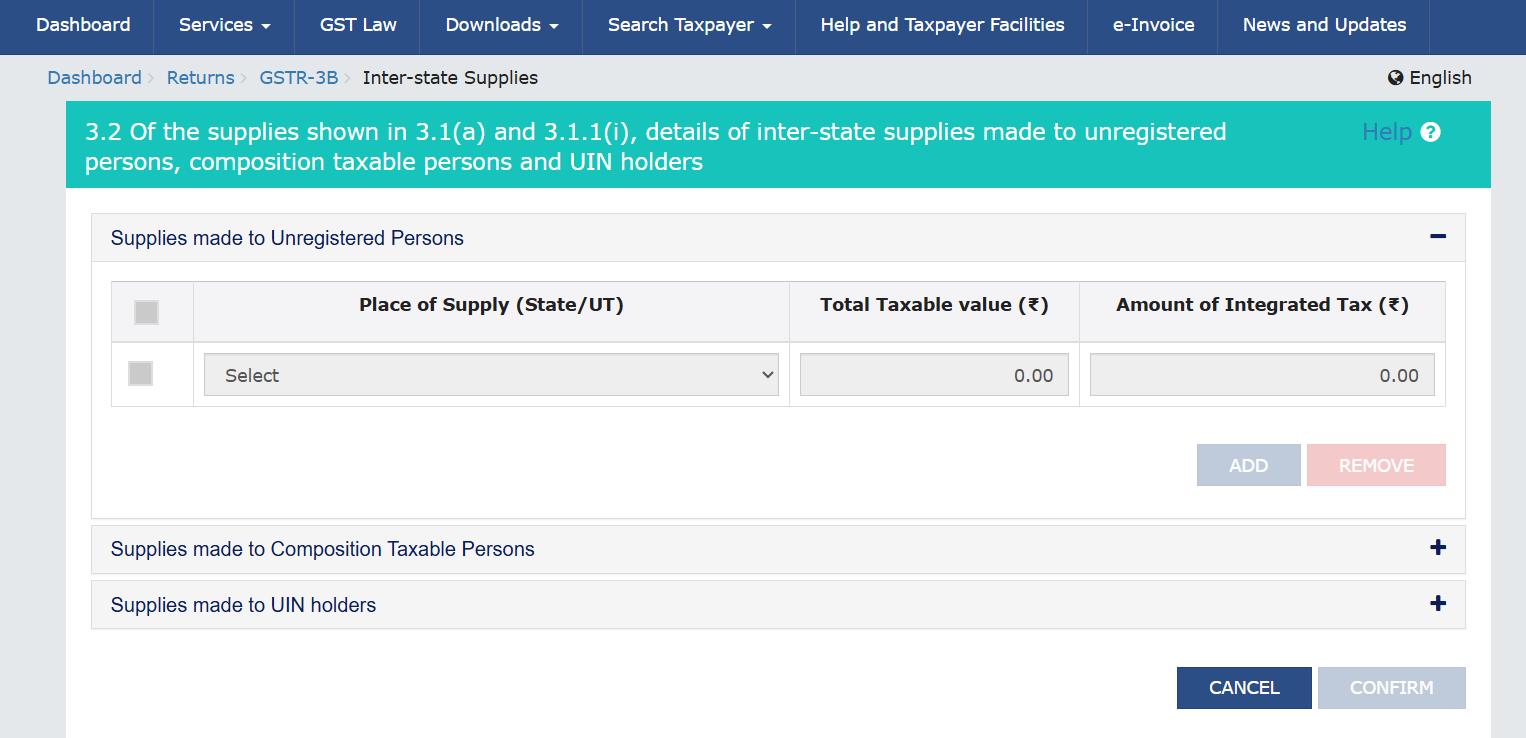

Table 3.2 of GSTR-3B Non-Editable from July 2025 – GSTN Advisory 617 Explained

At a Glance: From July 2025, Table 3.2 of GSTR-3B (inter-State supplies) will be auto-populated and non-editable on the [...]

GST Portal Security Enhancements July 2025 – Key Actions for Taxpayers [Advisory 616]

GST Portal Security Enhancements July 2025: What Taxpayers Need to Do Now [Advisory 616] Have you noticed new login [...]

SPL-05 Acceptance & SPL-07 Rejection in GST Waiver Scheme 2025: Explained [Stepwise Guide]

GST Waiver Scheme July 2025: SPL-05 Acceptance and SPL-07 Rejection – Complete Stepwise Guide Are you tracking your GST [...]

Top 4 IMS Mistake Solutions: Recover ITC & Fix Rejected Invoices Fast! (GSTN Advisory 2025)

Top 4 IMS Mistake Solutions: Recover ITC & Fix Rejected Invoices Fast! (GSTN Advisory Explained) Did you accidentally reject an [...]

E-Way Bill 2.0 Portal Launch: Enhanced Inter-Operable GST Services from July 2025

E-Way Bill 2.0 Portal Launch: A New Era in GST Compliance from 1st July 2025 E-Way Bill 2.0 Portal Launch: [...]

BREAKING: GSTN Clarifies GST Return 3-Year Filing Ban—What It Means for Your GST Compliance in 2025

⚠️ BREAKING: GSTN Clarifies GST Return 3-Year Filing Ban—What It Means for Your GST Compliance in 2025 The GSTN’s latest [...]

GST Amnesty SPL-01/02 Payment Mismatch? Advisory 610 Explained

GST Amnesty SPL-01/02 Payment Mismatch? Advisory 610 Explained Amnesty Appeal SPL-01 SPL-02 payment mismatch? The GST Amnesty Scheme 2025 under [...]

GST Amnesty Filing Glitch? Use This Workaround Before June 30

Urgent Alert: GST Amnesty Application Stuck? Your Step-by-Step Guide to the Alternate Filing Route (Advisory 609 Explained) The GST Amnesty [...]

QRMP GST Refund Validation – GSTN Advisory 608 Explained

Navigating GST Refunds as a QRMP Taxpayer: Lessons from GSTN Advisory No. 608 (QRMP GST Refund Validation) On June 7, [...]

HSN & Document Reporting in GSTR-1 Table 12/13 – Smooth in TaxPower GST

Mandatory HSN in Table 12 and Document Reporting in Table 13 of GSTR‑1 Is Now Live — Seamless Support [...]

Barring of GST Return Filing After Three Years – GSTN Implements Time-Limit from July 2025

Barring of GST Return Filing After Three Years – (GSTN to Implement GST Return Filing Time Limit From July 2025) [...]

Attention – GSTR-3B Hard-Locking for Auto-Populated Liability w.e.f July 2025

Attention – GSTR-3B Hard-Locking for Auto-Populated Liability w.e.f July 2025 (GSTR-3B becomes non-editable) As per recent advisories issued by GSTN, [...]

GSTR-1 Table 12 and Table 13 Compliance | HSN and Document reporting (May 2025)

GSTR-1 Table 12 and Table 13 Compliance: - Mandatory HSN & Document Reporting in GSTR-1/1A: GSTN Advisory May 2025 GSTR-1 [...]

GSTR-3B Mandatory Changes Halted: GSTN Advisory May 2025

Mandatory Changes to GSTR-3B Halted: GSTN Advisory Update May 2025 Introduction In a crucial update from the Goods and Services [...]

Essential Guide: GST Appeal Process and Waivers 2025

Essential Guide: GST Appeal Process and Waivers 2025 The Goods and Services Tax (GST) Amnesty Scheme 2025, introduced under Section 128A of [...]

GST Refund Filing Process Update: New Invoice-Based Process 2025

GST Refund Filing Process Updated: Move from Tax Period to Invoice-Based Applications The Goods and Services Tax Network (GSTN) has [...]

Invoice-wise Reporting in GSTR-7 Deferred: What Tax Professionals Need to Know

Invoice-wise Reporting in GSTR-7 Deferred: What Tax Professionals Need to Know The Goods and Services Tax Network (GSTN) recently announced [...]

Streamlining Air Cargo and Customs Transhipment Procedures : CBIC Circular No. 15/2025

Streamlining Air Cargo and Customs Transhipment Procedures: CBIC Circular No. 15/2025 Introduction On April 25, 2025, the Central Board of [...]

GSTR-1 Table 12 and 13 Advisory (May 2025): New HSN & Document Rules Explained

GSTR-1 Table 12 and 13 Advisory (May 2025): New HSN & Document Rules Explained The Goods and Services Tax Network [...]

GST Registration Process 2025: Step-by-Step Guide, Documents & Status Check

GST Registration Process 2025: Step-by-Step Guide, Documents & Status Check In recent years, GST practitioners and business owners have reported [...]

Mandatory Changes to GSTR-3B Reporting: Table 3.2 Becomes Non-Editable

Mandatory Changes to GSTR-3B : Table 3.2 Becomes Non-Editable The Mandatory Changes to GSTR-3B have brought a significant shift in [...]

Government Clarifies: No GST on UPI Transactions – Claims Are False

Government Clarifies: No GST on UPI Transactions – Claims Are False The Government of India has categorically denied recent claims [...]

Important Update: Phase-III Changes to Table-12 in GSTR-1/GSTR-1A

Changes in GSTR-1 / GSTR-1A : Phase-III Changes to Table-12 The Goods and Services Tax Network (GSTN) has announced the changes [...]

Biometric Authentication GST Registration in Assam 2025

Biometric Authentication GST Registration in Assam 2025 The Goods and Services Tax Network (GSTN) has introduced Biometric Authentication GST Registration [...]

Enhanced Security: 2FA e-Way Bill & e-Invoice Mandatory

Enhanced Security: 2FA e-Way Bill & e-Invoice Mandatory The National Informatics Centre (NIC) has rolled out a critical security upgrade [...]

Circular No. 248/05/2025-GST: Key Insights on Amnesty Scheme

Circular No. 248/05/2025-GST: Clarifications on GST Amnesty Scheme Under Section 128A of CGST Act The Government of India has issued [...]

Issues in Filing SPL 01/SPL 02 Under GST Waiver Scheme and Last date of filing!

Issues in Filing SPL 01/SPL 02 Under GST Waiver Scheme and Last date of filing! Dear Taxpayers, We have received [...]

Biometric Aadhaar GST Registration Uttar Pradesh Advisory

Biometric Aadhaar GST Registration Uttar Pradesh Advisory Dear Taxpayers, We are pleased to inform you about the latest updates to [...]

Advisory: Biometric Aadhaar Authentication for Directors

Advisory: Biometric Aadhaar Authentication for Directors Dear Taxpayers, We are pleased to inform you about a significant enhancement in the Biometric [...]

Important Advisory on GSTR-2B and IMS

Important Advisory on GSTR-2B and IMS The Goods and Services Tax Network (GSTN) has introduced significant updates to the GST [...]

Advisory for GST Registration Process (Rule 8 of CGST Rules, 2017)

Advisory for GST Registration Process (Rule 8 of CGST Rules, 2017 Dear Taxpayer, In line with recent developments in the [...]

Advisory: Form ENR-03 for Biometric Aadhaar GST E-Way Bill

Advisory: Form ENR-03 for Biometric Aadhaar GST E-Way Bill Dear Stakeholders, We are pleased to inform you about a new feature introduced [...]

Biometric Aadhaar GST Advisory: Jharkhand & Andaman

Biometric Aadhaar GST Advisory: Jharkhand & Andaman Dear Taxpayers, We are pleased to inform you about the latest updates to [...]

Biometric Aadhaar GST Advisory: Tamil Nadu & Himachal Pradesh

Biometric Aadhaar GST Advisory: Tamil Nadu & Himachal Pradesh We are pleased to inform you about the latest updates to [...]

Biometric Aadhaar GST Advisory: Maharashtra & Lakshadweep

Biometric Aadhaar GST Advisory: Maharashtra & Lakshadweep Dear Taxpayers, We are pleased to inform you about the latest updates to [...]

Advisory: E-Way Bill for Goods Under Chapter 71

Advisory: E-Way Bill for Goods Under Chapter 71 Dear Taxpayers and Transporters, This advisory aims to clarify the E-Way Bill [...]

Advisory: Introduction of E-Way Bill for Gold in Kerala

Advisory: Introduction of E-Way Bill for Gold in Kerala A new option for generating an E-Way Bill for gold has [...]

Attention – Hard-Locking of Auto-Populated Liability in GSTR-3B

Attention – Hard-Locking of Auto-Populated Liability in GSTR-3B This advisory provides important information regarding the hard-locking of auto-populated liability in [...]

CBIC Warns Against Fake Summons for GST Violations

CBIC Warns Against Fake Summons for GST Violations The Central Board of Indirect Taxes and Customs (CBIC) has issued a [...]

Advisory: Business Continuity for e-Invoice & e-Waybill

Advisory: Business Continuity for e-Invoice & e-Waybill This advisory highlights the alternate mechanisms and business continuity plans available for both [...]

Biometric Aadhaar GST Advisory for Rajasthan Applicants

Biometric Aadhaar GST Advisory for Rajasthan Applicants The Goods and Services Tax Network (GSTN) has introduced new measures to enhance [...]

Advisory: E-Way Bill Extension for 31st Dec 2024 Expiry

Advisory: E-Way Bill Extension for 31st Dec 2024 Expiry Introduction: The GST Network (GSTN) has resolved the technical challenges encountered [...]

Draft GSTR-2B Generation Date: December 2024

Draft GSTR-2B Generation Date: December 2024 In light of the extended due dates for filing GSTR-1 and GSTR-3B returns for [...]

Waiver Scheme Under Section 128A

Waiver Scheme Under Section 128A This advisory provides important information regarding the Waiver Scheme under Section 128A. Please take note [...]

Mandatory HSN Code in GSTR-1 & GSTR-1A: Phase-III

Mandatory HSN Code in GSTR-1 & GSTR-1A: Phase-III The Goods and Services Tax Network (GSTN) has announced the implementation of [...]

Waiver of Late Fee for Filing FORM GSTR-9C

Waiver of Late Fee for Filing FORM GSTR-9C The Central Board of Indirect Taxes and Customs (CBIC) has announced a [...]

Extension of Due Date for GSTR-1 & GSTR-3B

Extension of Due Date for GSTR-1 & GSTR-3B Dear Taxpayer, The Central Board of Indirect Taxes and Customs (CBIC) has [...]

How to Access the GST Common Portal and Use Digital Signature Certificates

How to Access the GST Common Portal and Use Digital Signature Certificates At TaxPower GST, we understand the importance of [...]

Biometric Aadhaar Verification for GST Registration in Ladakh

New Biometric-Based Aadhaar Authentication and Document Verification for GST Registration in Ladakh Introduction: The GST Network (GSTN) has introduced a [...]

Biometric Aadhaar Authentication for GST Registration in Chhattisgarh, Goa & Mizoram

Biometric Aadhaar Authentication for GST Registration in Chhattisgarh, Goa & Mizoram Introduction: The GST Network (GSTN) has introduced a new [...]

Simplified Guide to Filing Form SPL-02 for GST Waiver Scheme

GST Waiver Scheme: Simplified Guide to Filing Form SPL-02 Are you looking to avail the benefits of the GST waiver [...]

Biometric Aadhaar GST Verification in Arunachal Pradesh

Biometric Aadhaar GST Verification in Arunachal Pradesh Introduction: The GST Network (GSTN) has introduced a new biometric-based Aadhaar authentication and [...]

Guidelines for Accurate Entry of Receipt Numbers in the E-Way Bill System for Leased Wagons

Guidelines for Accurate Entry of Receipt Numbers in the E-Way Bill System for Leased Wagons Introduction: The GST Network (GSTN) [...]

Biometric Aadhaar GST Verification: Madhya Pradesh

New Biometric Aadhaar GST Verification / Authentication and Document Verification for GST Registration in Madhya Pradesh Introduction: The GST Network [...]

Mandatory Sequential Filing of GSTR-7 Returns: Important Advisory

Mandatory Sequential Filing of GSTR-7 Returns: Important Advisory Introduction: The GST Network (GSTN) has issued an advisory regarding the mandatory [...]

e-Invoicing Steps – A Comprehensive Guide

e-Invoicing Steps - A Comprehensive Guide Introduction: e-Invoicing is a significant step towards streamlining GST compliance in India. It involves [...]

Guide to GST’s New Invoice Management System (IMS)

Guide to GST's New Invoice Management System (IMS) In a significant leap forward for the Goods and Services Tax (GST) [...]

Biometric Aadhaar Authentication for GST Registration in Haryana, Manipur, Meghalaya, and Tripura

Biometric Aadhaar Authentication for GST Registration in Haryana, Manipur, Meghalaya, and Tripura Introduction: The GST Network (GSTN) has introduced a [...]

Authorized e-Invoice Verification Apps: A Comprehensive Guide

Authorized e-Invoice Verification Apps: A Comprehensive Guide Introduction: The GST Network (GSTN) has released a consolidated document listing authorized B2B [...]

Understanding the New Invoice Management System (IMS) and Its Benefits

Understanding the New Invoice Management System (IMS) and Its Benefits Introduction: The GST Network (GSTN) has launched the Invoice Management [...]

Hard-Locking of Auto-Populated Liability in GSTR-3B: What You Need to Know

Hard-Locking of Auto-Populated Liability in GSTR-3B: What You Need to Know Introduction: The GST Network (GSTN) has announced significant updates [...]

New Auto-Population Feature for GSTR-9/9C: What You Need to Know

New Auto-Population Feature for GSTR-9/9C: What You Need to Know Introduction: The GST Network (GSTN) has introduced a new feature [...]

New Invoice Management System (IMS) Launched for Taxpayers

New Invoice Management System (IMS) Launched for Taxpayers Introduction: The GST Network (GSTN) has introduced a new Invoice Management System [...]

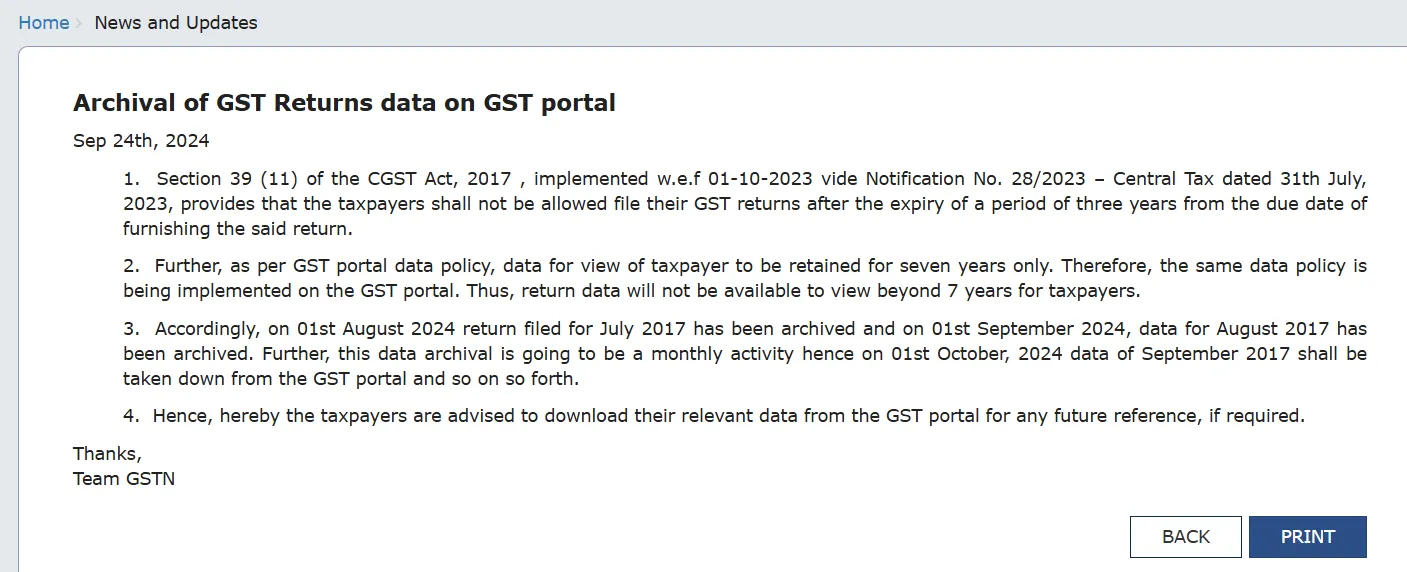

Restore GST Returns Data on Portal

Restore GST Returns Data on Portal (GSTN's 29th September advisory ) In a recent advisory issued on September 29, 2024, [...]

Urgent Update: GSTN Implements GST Data Archival Policy from October 1, 2024

GSTN Implements GST Data Archival Policy from October 1, 2024 Introduction (Read: GSTN Implements Data Archival Policy from October 1, [...]

What are the Improvements in GSTR-1 ?

What are the Improvements in GSTR-1?(Implemented on 26th November 2021 by GST Portal)As a part of GSTN’s efforts towards improving [...]

Reconcile and Prepare GSTR 9 And GSTR 9C in Five Easy Steps

Reconcile and Prepare GSTR 9 And GSTR 9C in Five Easy Steps Step 1:- Create Dealers in TaxPower GST Software by [...]