Mandatory GSTR-3B Table 3.2 Changes: Table 3.2 Becomes Non-Editable

What are the mandatory GSTR-3B Table 3.2 Changes?

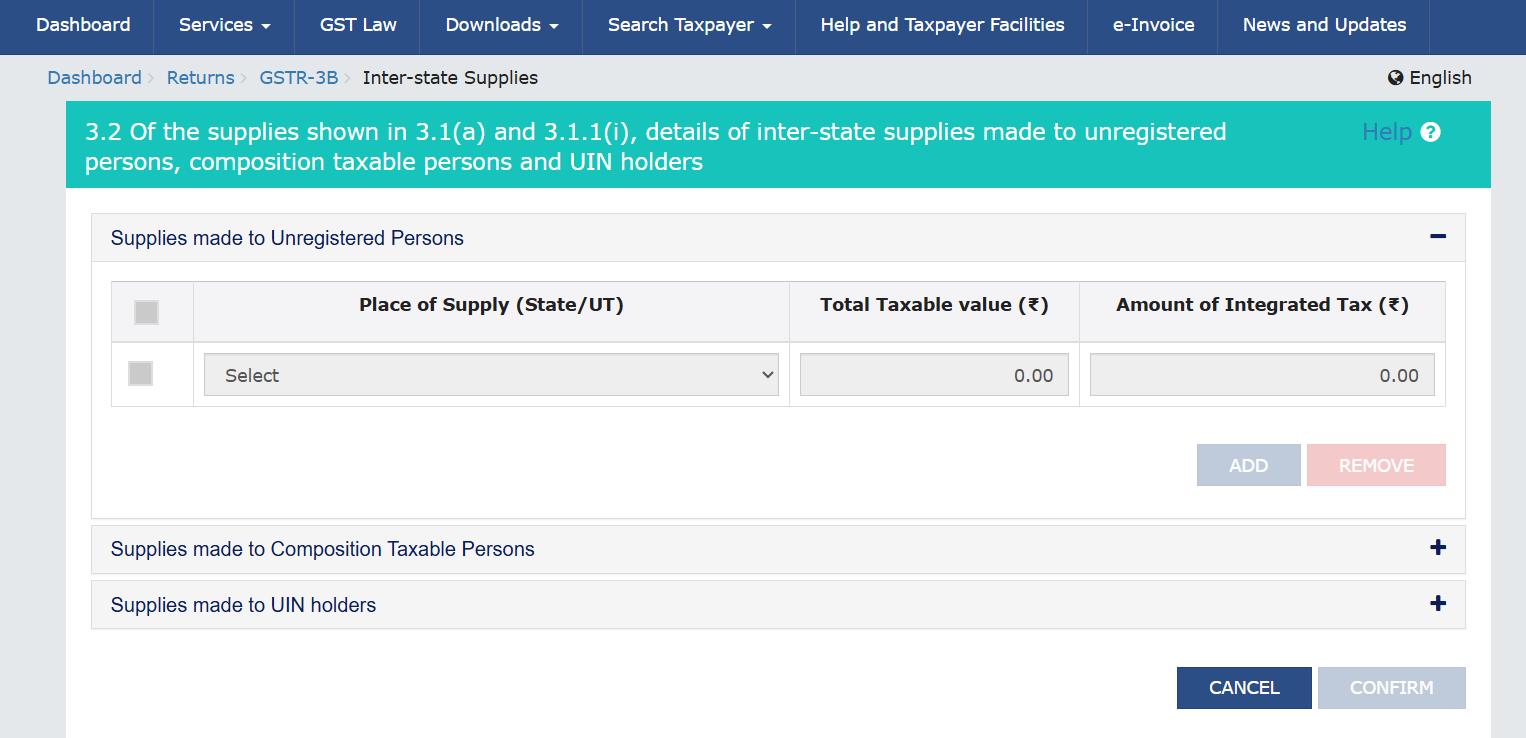

Table 3.2 of GSTR-3B plays a crucial role in GST reporting. It is dedicated to capturing interstate supplies made to:

- Unregistered persons (consumers buying from outside their state)

- Composition taxpayers (businesses under the GST’s composition scheme)

- UIN holders (Unique Identification Number holders, including embassies and international organizations)

This table ensures that GST revenue is correctly allocated between the Central and State governments. Before, businesses could enter values in Table 3.2 by hand. Starting in April 2025, the GSTN will make a big change. The table will be non-editable and auto-populated.

Key Changes to GSTR-3B for Table 3.2

1. Auto-Populated & Non-Editable Values

From April 2025, Table 3.2 of GSTR-3B will be completely auto-populated and non-editable. The values will be derived solely from:

- GSTR-1 (Outward supplies)

- GSTR-1A (Amendments and corrections)

- IFF (Invoice Furnishing Facility)

This change has been implemented to reduce manual errors and ensure accurate reporting of interstate supplies. Taxpayers must be extra careful to verify their GSTR-1 and GSTR-1A before submission.

For official details, refer to the GSTN advisory.

2. Revised Correction Process

Since Table 3.2 can no longer be edited manually, taxpayers must adopt a new correction method. Any errors or changes must be rectified through:

- GSTR-1A amendments before submitting GSTR-3B.

- Adjustments in subsequent GSTR-1/IFF filings.

This ensures data integrity and aligns with the GST compliance framework.

Why This Change Matters

The GSTN’s decision to lock Table 3.2 ensures:

✅ Eliminating discrepancies between GSTR-1 and GSTR-3B.

✅ Reduction in manual errors for inter-state supply reporting.

✅ Improved data integrity across GST returns.

✅ Simplified reconciliation for tax authorities, making GST audits smoother.

Compliance Checklist for Taxpayers

To prevent errors and ensure smooth GST filing, businesses should:

✔ Verify inter-state supplies in GSTR-1/GSTR-1A before submission.

✔ Reconcile invoice data before filing GSTR-3B to prevent mismatches.

✔ Use GSTR-1A for amendments instead of direct edits in GSTR-3B.

✔ Update accounting software to align with the new non-editable reporting system.

By following these steps, businesses can avoid penalties, notices, and reconciliation issues in future tax filings.

Key Deadlines & Filing Process

- No cutoff date for GSTR-1A amendments before GSTR-3B submission.

- Corrections can be made until the GSTR-3B filing is complete.

- Subsequent period GSTR-1 can be used for corrections made after submission.

FAQs on GSTR-3B Table 3.2 Changes

FAQ’s

1. What are the changes related to reporting supplies in Table 3.2?

Starting from the April 2025 tax period, the auto-populated values in Table 3.2 of GSTR-3B for inter-state supplies made to unregistered persons, composition taxpayers, and UIN holders will be non-editable, and taxpayers will need to file GSTR-3B with the auto-populated values generated by the system only.

2. How can I rectify values in Table 3.2 of GSTR-3B if incorrect values have been auto-populated after April 2025 period onwards due to incorrect reporting of the same through GSTR-1?

If incorrect values are auto-populated in Table 3.2 after April 2025, taxpayers need to correct the values by making amendments through Form GSTR-1A or through Form GSTR-1/IFF filed for subsequent tax periods.

3. What should I do to ensure accurate reporting in Table 3.2 of GSTR-3B?

Taxpayers should ensure that the inter-state supplies are reported correctly in their GSTR-1, GSTR-1A, or IFF. This will ensure that the accurate values are auto-populated in Table 3.2 of GSTR-3B.

4. Till what time/date I can amend values furnished in GSTR-1 through Form GSTR-1A?

As there is no cut-off date for filing Form GSTR-1A before GSTR-3B which means Form GSTR-1A can be filed after filing Form GSTR-1and till the time of filing Form GSTR-3B. Hence, any amendment required in auto-populated values of table 3.2, same can be carried out through Form GSTR-1A till the moment of filing GSTR-3B.

How TaxPower GST Simplifies GSTR-3B Filing

GST compliance can be complex, but TaxPower GST makes it effortless. Here’s how:

- Automated reconciliation ensures accurate reporting of interstate supplies.

- Real-time data validation prevents errors before submission.

- Seamless integration with GSTR-1 and GSTR-1A for hassle-free amendments.

- User-friendly dashboard simplifies tax filing and compliance tracking.

- Intelligent GSTR Recociliation: all types of reconciliation such as GSTR1 vs GSTR-3B, GSTR-2B vs GSTR-2 and many more.

🚀 Get a 30-day free trial of TaxPower GST and experience seamless GSTR-3B filing with automated compliance checks. Sign up today and streamline your tax filing process! Learn more at TaxPower GST.

Blog Ref: GSTN Portal