What are the Improvements in GSTR-1?

(Implemented on 26th November 2021 by GST Portal)

As a part of GSTN’s efforts towards improving GST compliance on the GST portal, GST Portal has revamped and made Improvements in GSTR-1 / IFF to improve the Taxpayer user experience. Due to these enhancements, the Saving of the GSTR-1 details on the GST portal has become more efficient and user-friendly. Those changes do not change the functionality and the operations of Tax Power GST Software. Tax Power GST Software has already anticipated those changes in its functionality, and its development is in line with the GST portal.

What are the Improvements in GSTR-1?

It is essential to implement those changes gradually incrementally so that Tax Payer adapts to the changes smoothly and becomes familiar with them.

Two phases of the implementation will minimize disruption to the taxpayers. The GSTN portal has announced Phase One in the advisory and Phase Two later. In a corresponding phase, the GST portal will review their feedbacks.

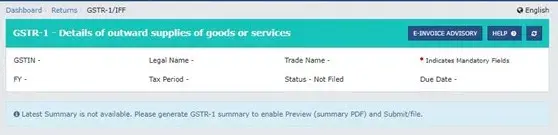

As usual, you can view GSTR-1 by navigating from

Returns Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online

-

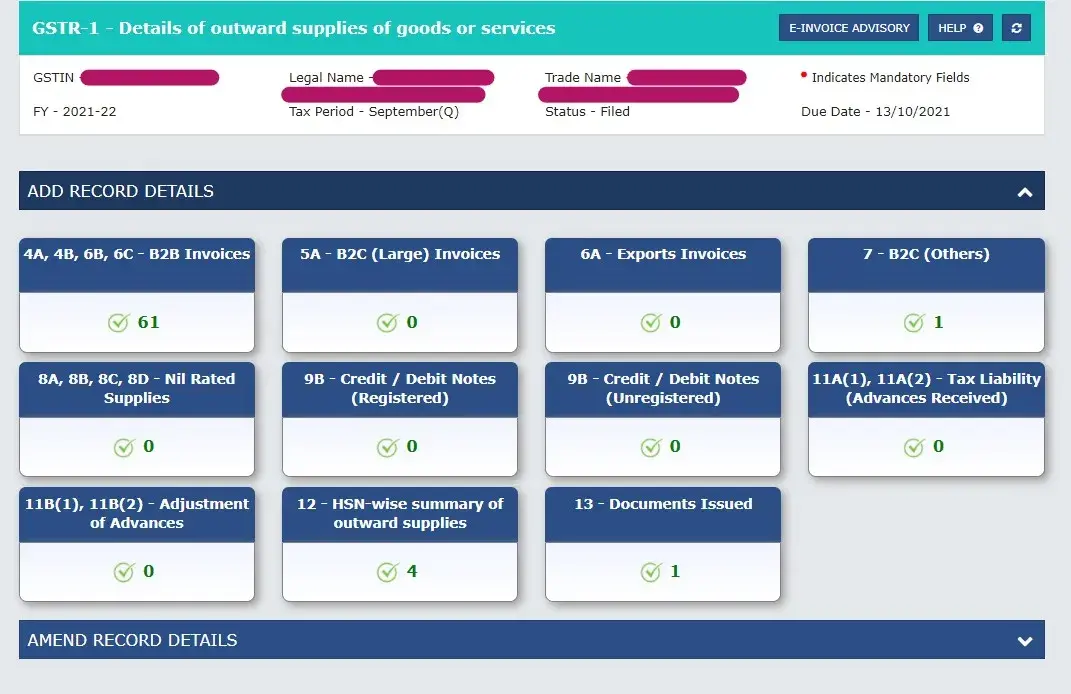

Reorganized GSTR-1 Dashboard.

i) There are two groups of GSTR 1 / IFF a) ADD RECORD DETAILS and b) AMEND RECORD DETAILS

ii) The Taxpayer can easily navigate adding or amending record details in GSTR 1 / IFF. All the tables/tiles are available under “ADD RECORD DETAILS.” Whereas more information of amendments of previously filed records is available under “AMEND RECORD DETAILS.”

iii) You will be able to see “ADD RECORD DETAILS” in expanded form (visible) by default, whereas “AMEND RECORD DETAILS” is in the collapsed state (hidden). GST Portal has provided such design, as Tax Payers amends only 1% of the details added.

iv) Only selective Tax Payers having aggregate turnover above a particular threshold require an e-invoice section. So E-invoice advisory and help buttons are available now at the top of the dashboard page for ease of access.

2) Table/Tile Document Counts

For each tile (table), the document count is now more informative with color-coding. The count of documents uploaded and their status like Saved, Pending, Errored is also available. Suppose there are any pending or errored records in any of the tables of GSTR-1/IFF. In that case, on the dashboard itself, the Taxpayer can confirm. Real-time updation of the count of records in the tiles by system help in easy reconciliation. The tile will be highlighted to Red Colour if there is an error for the added record. Below is the sample image.

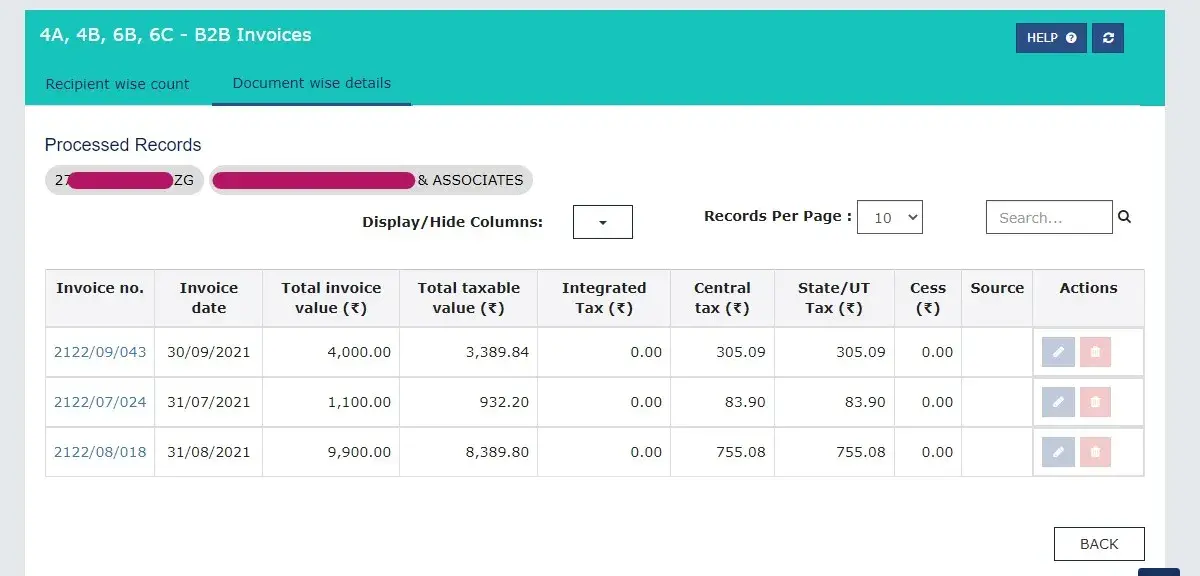

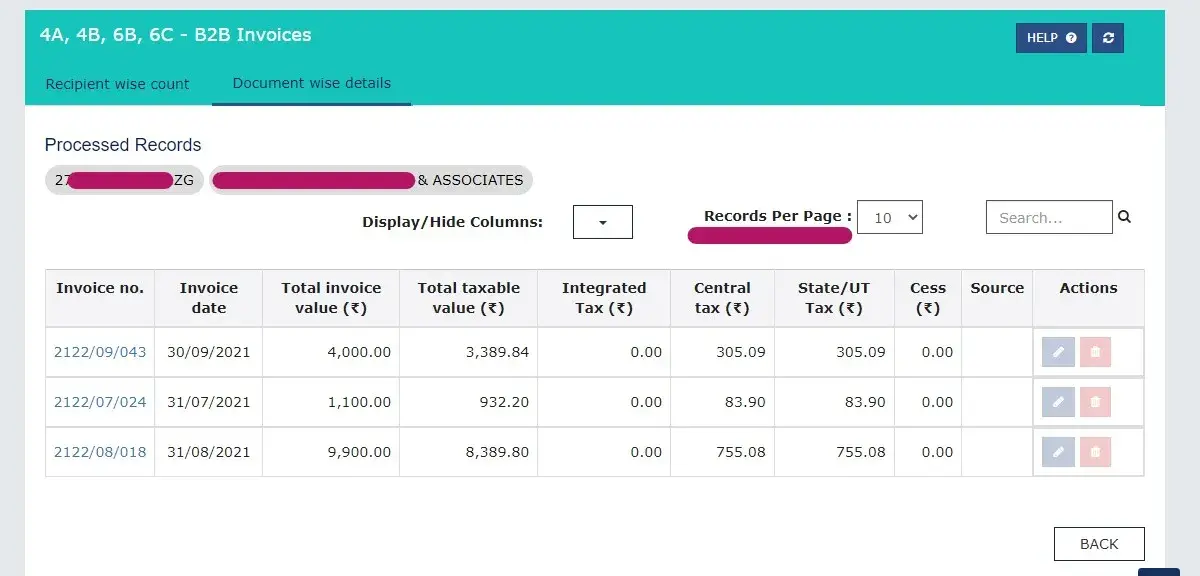

3) Enhancement in B2B and CDNR table/tile

The details of the recipient-wise count of records are available in a new record details table. The following columns are available in Record details.

i) Taxpayer type – Type of recipient taxpayer (Regular, SEZ, and Composition)

ii) Processed invoice – The number of processed invoices will be available in this column with a hyperlink. On clicking it, the Taxpayer will navigate to the document details page to view all the records added for the respective recipient(s).

iii) Pending/errored invoice – The number of pending invoices will be available in this column with a hyperlink. On click of it, the Taxpayer can navigate to the pending/errored records details page to view all the records in pending or errored status for the respective recipient(s).

iv) Add Invoice – The Taxpayer can add new records for the selected recipient. On click of + symbol, add page shall open with pre-filled recipient GSTIN. On click of save, add page will reopen so that taxpayers can continue to add multiple records.

v) Search – In the Document details page, general search functionality is available. The Taxpayer can now search specific records of a particular GSTIN using this utility. This will help the Taxpayer to search added records seamlessly.

4) Records per page feature

To ease of viewing, the system has now provided the records per page feature in all the tables under ADD RECORD DETAILS section leading. The view of the number of records per page is now customizable by the TaxPayer. By default, the Records per page will be set at ten records per page and increased to view 50 records per page.

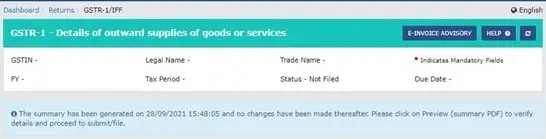

5) Steps to file GSTR-1/IFF

A new check has been introduced in the system to check whether the Taxpayer has added new records after generating the Summary. The Taxpayers must note that there would be a changed flow in such a situation. The system will disable SUBMIT and PREVIEW buttons until the system generates a new summary after updating records if the Taxpayer adds new records. This check will enable the Taxpayer that the filing of GSTR-1/IFF is correct & update the Summary only, and no mistake happens in this regard.

Steps to upload details of outward supplies and file GSTR-1/IFF:-

a) The Taxpayer can add or amend records in respective tables of GSTR-1/IFF.

b) A taxpayer shall click on GENERATE SUMMARY button; once they save the records.

c) The system will enable PREVIEW and SUBMIT buttons after successfully generating the Summary.

d) The Taxpayer can click the PREVIEW button to download the summary PDF if the Taxpayer intends to verify the Summary of GSTR-1/IFF.

e) The Taxpayer can make necessary changes before SUBIT/FILE of GSTR-1/IFF. After updating records, they have to generate a new summary by clicking the GENERATE SUMMARY button. However, if The TaxPayer adds any new records after generating the Summary, the SUBMIT and PREVIEW buttons will be disabled.

f) If the latest Summary is not available/generated, the system will inform the Taxpayer to generate a new summary.

g) The Taxpayer must click on the Generate summary button and submit/file GSTR-1/IFF after Taxpayer makes the change in GSTR-1/IFF.

New enhancements expected in the next phase:-

- Enhanced GSTR-1 online summary view.

- Recipients wise Summary (PDF).

- Remove SUBMIT button before FILE.

GSTN portal is enhancing the facility to file GSTR-1/IFF to a great extent. Tax Power GST software is developed in alignment with GSTN functionality. It is continuously updating its functionalities with the changes in GST Portal. And always try to add more functionalities on top of it. Tax Power GST Software users get the benefit of this faster development.